Let’s discuss about Top 10 Payment Gateways in India. A payment gateway is a technology that provides protected transfer of payment information between a customer, a merchant, and monetary institutions during online transactions. It acts as a medium, encrypting insightful data like credit card details to certify safety and prevent fraud.

They sustain several payment methods, including credit/debit cards, digital wallets, and bank transfers. Some examples of payment gateways are Paytm, PayPal, Stripe, and Razorpay.

These gateways are broadly used in e-commerce, they make online payments simpler, ensuring handiness and safety for both merchants and customers. In this article, we have discussed the top 10 payment gateways of India.

One of India’s largest and mostly used payment gateways is Paytm. It offers a seamless payment experience across various platforms. It provides more than 100 payment facilities, including credit/debit cards, UPI, net banking, and Paytm Wallet.

Features:

Benefits:

Use Case: Small and large businesses in retail, education, and healthcare gets benefit from Paytm’s dependability and ease of use. This is one of the top 10 Payment Gateways in India.

Razorpay is a full-stack payment alternative that has earned huge popularity among startups and enterprises. It provides all major payment options, including cards, UPI, net banking, and wallets.

Features:

Benefits:

Use Case: Perfect payment method for SaaS platforms, eCommerce stores, and freelancers.

PayU is a trustworthy payment gateway space in India, known for its strong security and ease of integration. It provides more than 150 payment facilities and is broadly used across industries.

Features:

Benefits:

Use Case: Large-scale businesses that are looking for scalability and security must rely on this payment gateway.

CCAvenue is one of the oldest and best payment gateways in India. It provides support to various industries, including hospitality, education, and retail.

Features:

Benefits:

Use Case: Enterprises and businesses with diverse customer bases are suggested to choose this payment gateway.

Instamojo is a user-friendly other best payment gateways designed for small-scale businesses, freelancers, and entrepreneurs. It makes online payments easy with additional services like online stores and logistics.

/entrackr/media/post_attachments/wp-content/uploads/2018/04/Instamojo.jpg)

Features:

Benefits:

Use Case: It is an ideal option for individuals and small businesses venturing into online sales.

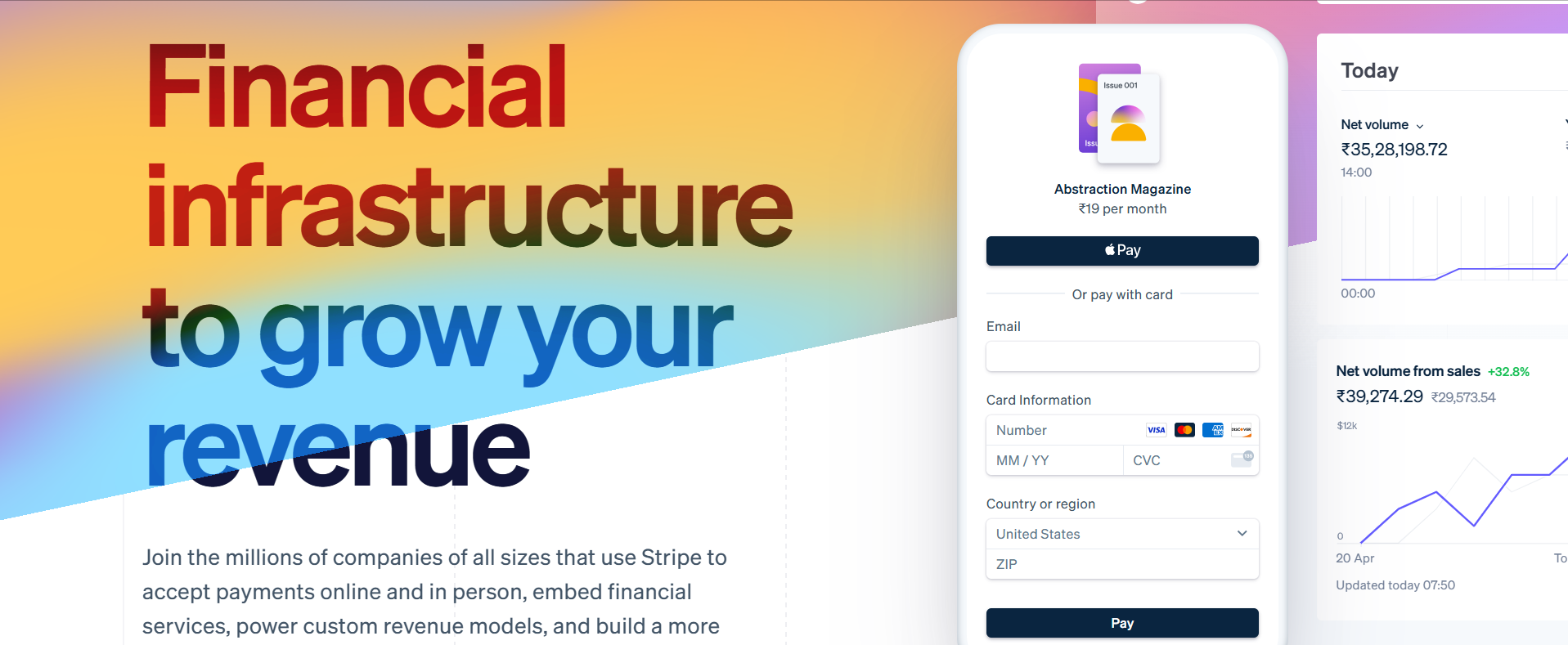

Stripe is an international payment gateway that has earned traction in India for its developer-friendly API and developed features.

Features:

Benefits:

Use Case: Perfect for technology-driven organizations and start-ups scaling globally.

Cashfree Payments is recognized for its fast settlements and inventive payment solutions. It supports businesses of all sizes, from startups to large multinational corporations.

Features:

Benefits:

Use Case: Perfect for businesses that manage numerous stakeholders or that require instant settlements.

HDFC SmartHub is another best payment gateways provided by one of India’s leading banks, HDFC. It provides customized solutions for businesses of all sizes.

Features:

Benefits:

Use Case: Businesses that are looking for a trusted banking partner for payment solutions can choose this gateway.

Zaakpay is a budding payment gateway that provides an easy and protected payment process for businesses in India.

Features:

Benefits:

Use Case: Small to medium-sized businesses that are exploring digital payments can use this payment gateway.

PayGlocal concentrates in allowing businesses to recognize international payments flawlessly. It supports several currencies and ensures agreement with global standards.

Features:

Benefits:

Use Case: Perfect choice for export businesses and global eCommerce platforms.

Read More :- Top Question Related to HTML to Crack Interview

Read More :- Top 7 Advantages of Managed VPS Hosting

India’s digital economy is budding rapidly, and payment gateways play a vital function in facilitating online transactions. Each of the above mentioned payment gateways has exclusive features customized to precise business needs. Choosing the accurate payment gateway depends on various factors like transaction volume, business size, and target audience.

By considering these top payment gateways, businesses can improve customer contentment and make growth in India’s economic market.

Let's discuss about Top 10 Payment Gateways in India. A payment gateway is a technology that provides protected transfer of…

In today’s world where competition is all around, companies should think about all the critical aspects before developing any system.…

Ruby on Rails and Node.js are two widely used server-side solutions for web application development, capable of handling complex applications…